The way we manage payments is evolving, and PayPal is at the forefront of this transformation. One of the most significant changes in recent months is the expansion of PayPal’s Buy Now, Pay Later (BNPL) service, which allows consumers to purchase products and pay in installments. This trend is gaining momentum as more users opt for flexible payment solutions. In this article, we’ll explore how PayPal’s BNPL service is reshaping digital financial services, its benefits, and why it’s becoming an essential tool for both consumers and businesses.

What is PayPal’s “Buy Now, Pay Later” (BNPL) Service?

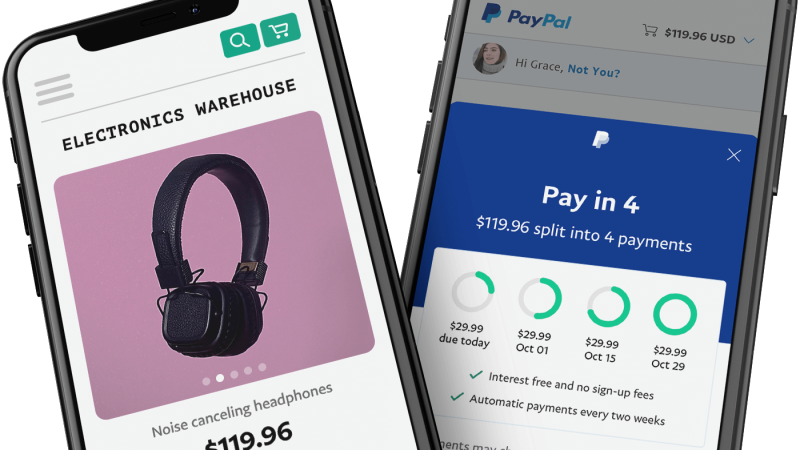

PayPal’s Buy Now, Pay Later (BNPL) service allows consumers to shop online and split their purchases into smaller, interest-free payments over time. Users can choose a payment plan that suits their budget, whether that’s paying in four installments over six weeks or selecting a longer-term option for bigger purchases. This service gives consumers the flexibility to shop without the immediate financial burden, which has made it incredibly popular, especially among younger shoppers who are increasingly seeking alternative payment methods.

Why is PayPal’s BNPL Service So Popular?

- Financial Flexibility and Convenience

The main draw of PayPal’s BNPL service is the ability to spread the cost of a purchase over time. Consumers can make larger purchases without worrying about paying the full amount upfront. This flexibility is a major advantage, particularly for customers managing multiple expenses or looking to buy products they might not be able to afford with a single payment.

- Interest-Free Payments

Unlike traditional credit cards, which charge interest, PayPal’s BNPL service offers interest-free installments. This feature makes it an attractive option for consumers who want to avoid paying extra fees while enjoying the convenience of installment payments. As long as payments are made on time, users can enjoy the benefits of interest-free financing.

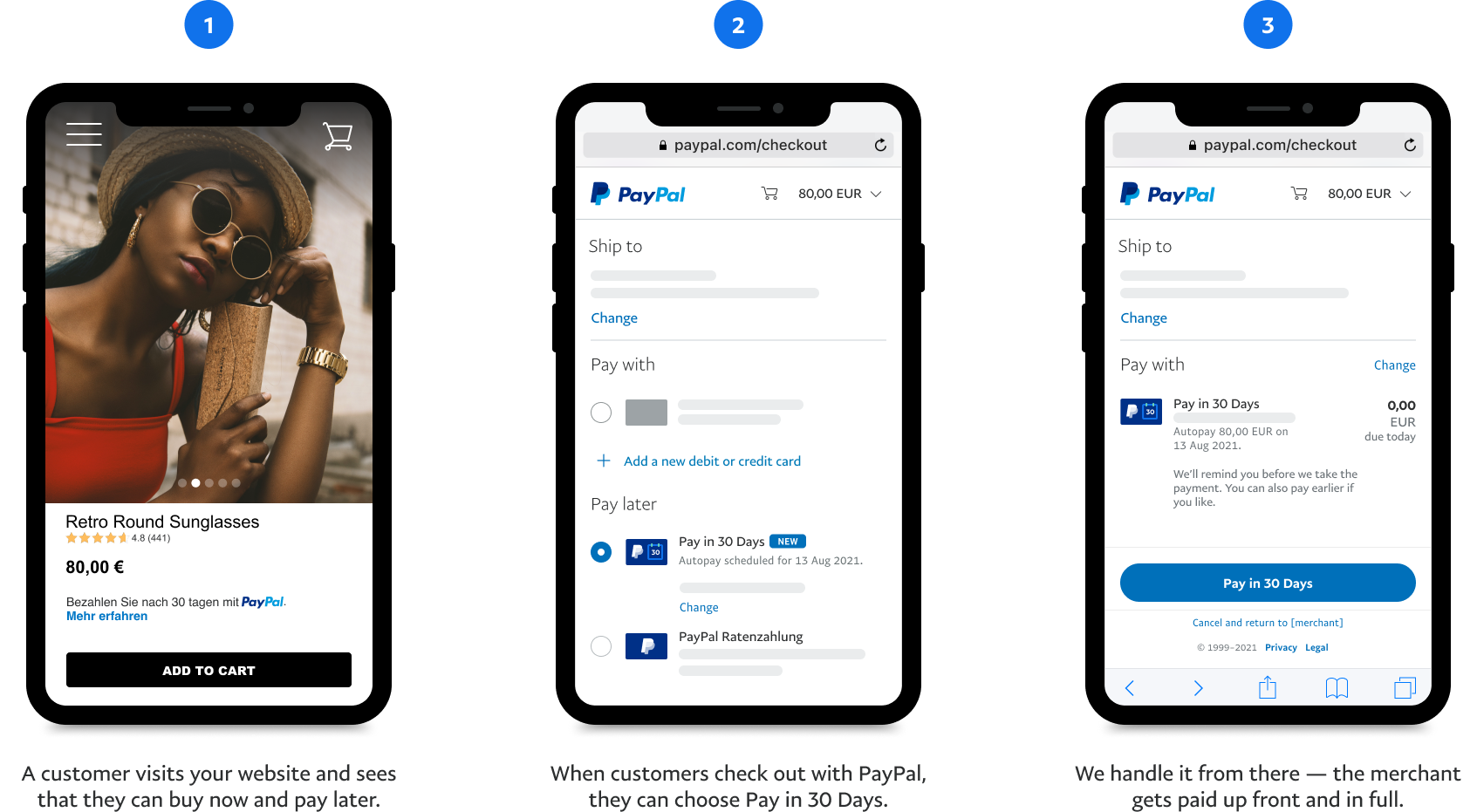

- A Seamless Shopping Experience

PayPal’s BNPL service integrates seamlessly with the platform’s existing payment system, making it easy for users to opt for installment payments during checkout. With PayPal’s widespread adoption, many merchants already support BNPL, which makes it easy for customers to choose this payment option across various online stores.

- Growing Adoption Among Younger Consumers

The millennial and Gen Z generations are increasingly turning to BNPL services as they seek more flexible payment methods. With a greater focus on financial control and debt avoidance, younger shoppers see BNPL as a way to manage purchases without relying on traditional credit cards.

How PayPal’s BNPL Expansion is Shaping the Future of Digital Payments

- A Shift Towards Digital-First Payments

PayPal’s BNPL service is contributing to the growing trend of digital-first payments, which are becoming the standard for e-commerce transactions. Consumers are now more comfortable using online payment solutions like BNPL for everyday purchases, which reflects a shift away from cash-based or even traditional credit card transactions. BNPL offers a user-friendly and accessible way to pay for goods and services, especially in a world where digital transactions are increasingly favored.

- Impact on E-Commerce Sales

Businesses that offer BNPL as a payment option are seeing higher conversion rates and increased sales. By enabling customers to spread out the cost of their purchases, merchants are reducing barriers to purchase. Consumers who might have hesitated to buy an expensive item can now make the purchase knowing they can pay in installments. For merchants, this means a boost in average order value (AOV) and customer loyalty, as shoppers appreciate the flexibility and convenience.

- Expanding Access to Credit

Traditional credit options can be difficult to access for individuals with limited credit history or poor credit scores. PayPal’s BNPL service offers an alternative to consumers who might not qualify for traditional loans or credit cards. By offering a flexible, low-risk way to make payments, PayPal is helping democratize access to credit for millions of consumers around the world.

- Increased Competition Among Payment Providers

The growing popularity of BNPL services is encouraging other payment providers to introduce similar services. Companies like Afterpay, Klarna, and Affirm are competing with PayPal by offering their own BNPL options, driving innovation and improving the overall customer experience. This growing competition is a sign of how BNPL is becoming a mainstream financial service and a key part of the future of digital payments.

Benefits of PayPal’s BNPL Service for Consumers

1. Budget Control

Consumers using PayPal’s BNPL service have the flexibility to manage their spending more effectively. With payments spread out over time, it’s easier to fit larger purchases into their budget. This allows for better control over finances without the need for large upfront payments.

2. Quick and Easy Sign-Up Process

To use PayPal’s BNPL service, consumers simply need a PayPal account. The sign-up process is quick and easy, allowing users to start using the service almost instantly without the need for extensive credit checks or paperwork.

3. Transparent Terms

PayPal is transparent about its BNPL terms. There are no hidden fees as long as payments are made on time. This transparency is crucial for building trust with users who may have been hesitant to use similar services in the past due to concerns about hidden costs or unclear repayment schedules.

Benefits of PayPal’s BNPL Service for Merchants

1. Increased Conversion Rates

Offering BNPL as a payment option increases the likelihood that customers will complete their purchases. When consumers know they can pay over time, they are more likely to finalize a transaction. This directly translates into higher conversion rates for merchants.

2. Attracting New Customers

Merchants that accept PayPal’s BNPL service are attracting a broader audience, including younger consumers and those who may not have access to traditional credit. This helps businesses tap into new customer segments and grow their customer base.

3. Low Risk and Simple Integration

PayPal assumes most of the financial risk associated with BNPL transactions, providing merchants with peace of mind. Additionally, integrating PayPal’s BNPL service into an e-commerce store is simple, as it’s part of the existing PayPal platform.

PayPal’s Buy Now, Pay Later expansion is making waves in the world of digital payments. As consumers continue to seek more flexible and convenient ways to pay, BNPL services are becoming a vital part of the e-commerce experience. With increased adoption, especially among younger consumers, and a growing number of businesses offering BNPL, it’s clear that this payment model is here to stay.

For businesses, adopting PayPal’s BNPL service can mean more sales, greater customer loyalty, and a competitive edge. For consumers, it’s an easy, flexible way to manage purchases without worrying about paying upfront. As the BNPL trend continues to expand, it will play a significant role in the future of digital financial services.

Call to Action:

Is your business ready to leverage the power of PayPal’s BNPL service? Start offering flexible payment options to your customers and watch your sales grow. For consumers, the next time you shop online, look for BNPL as a payment option and enjoy the convenience of paying over time!